President Donald Trump signed the

One Big Beautiful Bill Act

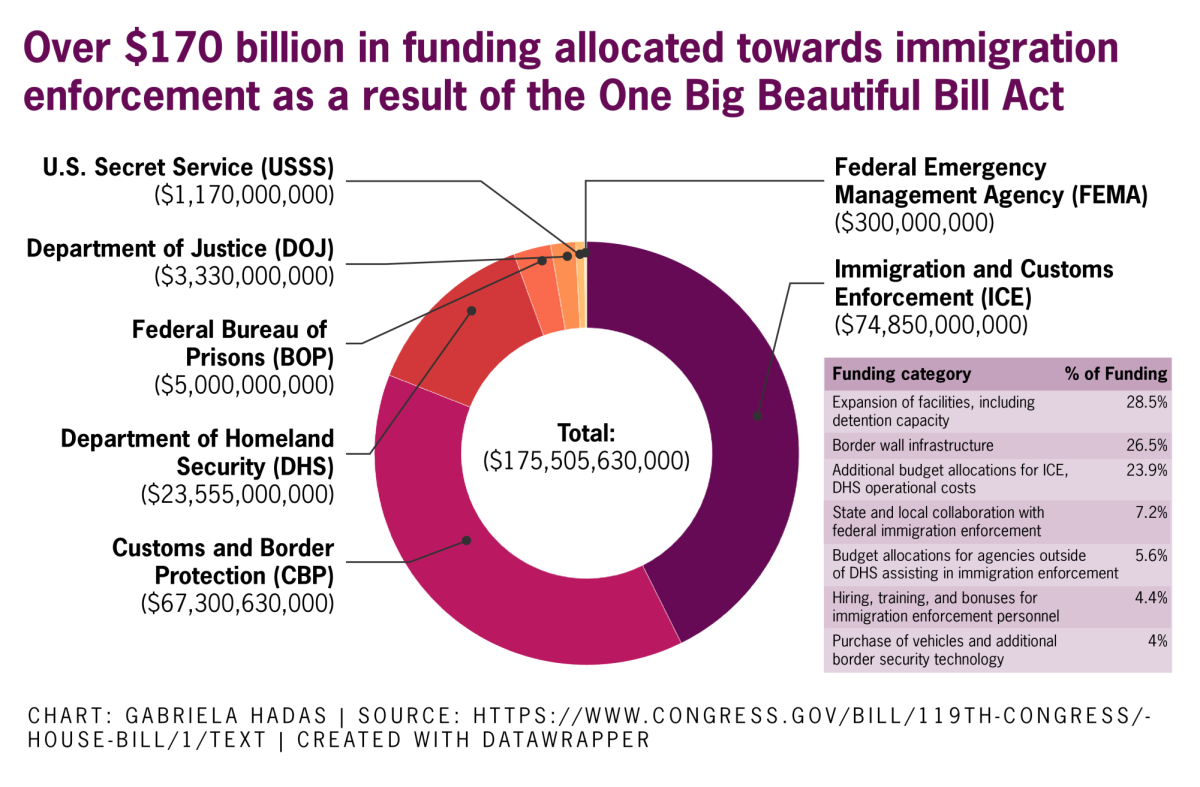

into law on July 4, which directs over $170 billion toward immigration enforcement. The law, otherwise known as H.R. 1, emphasizes collaboration between local and state law enforcement to carry out immigration tasks alongside federal agencies.

In a sweeping legislative push, increased spending for immigration enforcement is partly funded through cuts to major governmental assistance programs, such as the Supplemental Nutrition Assistance Program, or SNAP, Medicaid and Medicare. The intention behind this is to “dramatically increase” the resources available to enforce immigration policy, said Néstor Rodríguez, a sociology professor whose work focuses on international migration and border enforcement issues.

Jaime Puente, the director of Economic Opportunity at Every Texan, a

nonpartisan policy research organization

, said the potential impact of H.R. 1 should be understood in conjunction with the past state legislative session, particularly Texas Senate Bill 8. The law

mandates

most Texas sheriffs to enter into agreements with federal immigration authorities under the 287(g) program.

H.R. 1 provides $13.5 billion toward individual states to reimburse them for the costs associated with assisting federal immigration enforcement, according to the bill.

“Texas is second only to California in the number of immigrants that live here, work here and pay taxes here,” Puente said. “With the passage of H.R. 1, with the increase in resources for (Immigration and Customs Enforcement), border security, we are going to see Texas targeted more directly.”

Over four years, H.R. 1 would allocate approximately $46.5 billion for border wall infrastructure and approximately $45 billion to increase capacity for detention centers. Customs and Border Patrol would also receive approximately $7.8 billion to support hiring, training and bonuses for immigration enforcement personnel.

The H.R. 1 also contains a provision that would require a Social Security number to claim the Lifetime Learning and American Opportunity Tax Credits, which could exclude some undocumented students who previously qualified using an

ITIN

. The American Opportunity Tax Credit can provide up to $2,500 to help cover tuition and education expenses. The Lifetime Learning Credit can cover up to $2,000 of education-related expenses per student.

“This is part of a larger attack on access to higher education for not just undocumented students, but students who might not have a particular (legal) status,” Puente said. “Those students are under attack as well.”

Additionally, ICE received a budget increase of over $29 billion, making it the highest-funded federal law enforcement agency, according to

PBS

.

Rodríguez said it is important to understand immigration policy alongside global migration patterns, specifically the movement of people seeking labor across international borders, such as the U.S. and Mexico.

“The future is one of more mobility of capital and labor, not less mobility for the prosperity of capitalist economies to flourish and function and become prosperous,” Rodríguez said. “To the extent that we limit capital migration or labor migration, we create disadvantages for ourselves.”

H.R. 1 would also limit pathways to legal migration by imposing higher fees associated with gaining asylum, Temporary Protected Status and immigration court proceedings. Rodríguez said that given the significant presence of immigrant workers across the U.S., the economic impact on low-wage sectors like agriculture would be especially pronounced.

“We haven’t done a realistic assessment of what’s the value of immigrant labor for us and where we need it and how we can authorize it if we need it,” Rodriguez said. “We need immigration policies for the 21st century.”